How much will it cost to rebuild after an Earthquake in Southern California?

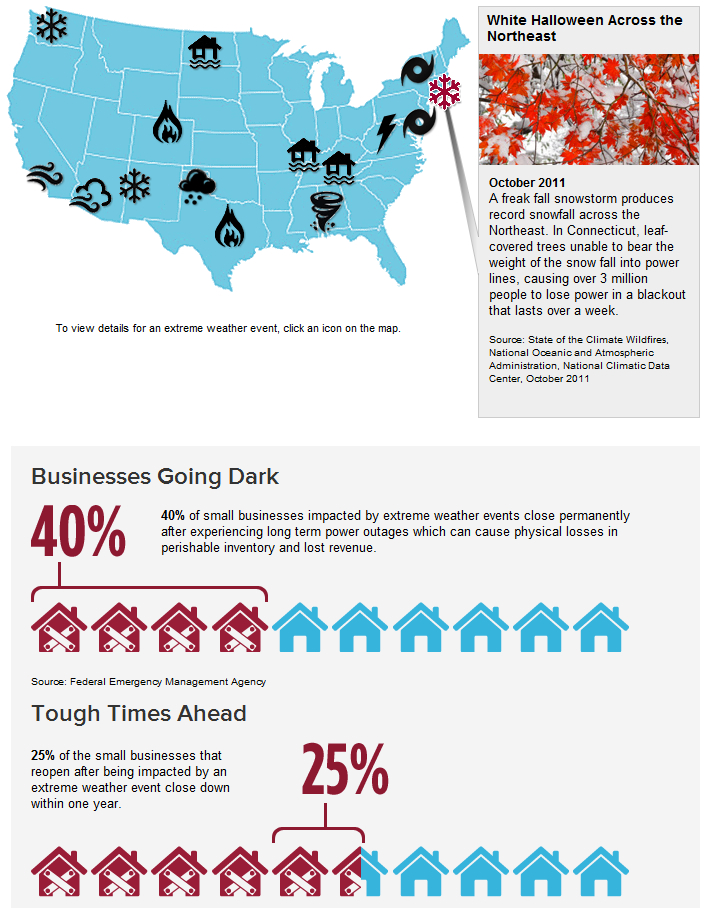

Homeowners and Commercial Property owners may be surprised when it comes time to rebuild their properties following an earthquake or other catastrophic event. The reason? “Demand Surge“. It costs more to rebuild when many other buildings were also damaged in the same earthquake, fire, flood, riot, etc because everyone else is scrambling to hire the same contractors, buy the materials, and navigate whatever debris or downed systems or fallout from the disaster.

Homeowners and Commercial Property owners may be surprised when it comes time to rebuild their properties following an earthquake or other catastrophic event. The reason? “Demand Surge“. It costs more to rebuild when many other buildings were also damaged in the same earthquake, fire, flood, riot, etc because everyone else is scrambling to hire the same contractors, buy the materials, and navigate whatever debris or downed systems or fallout from the disaster.

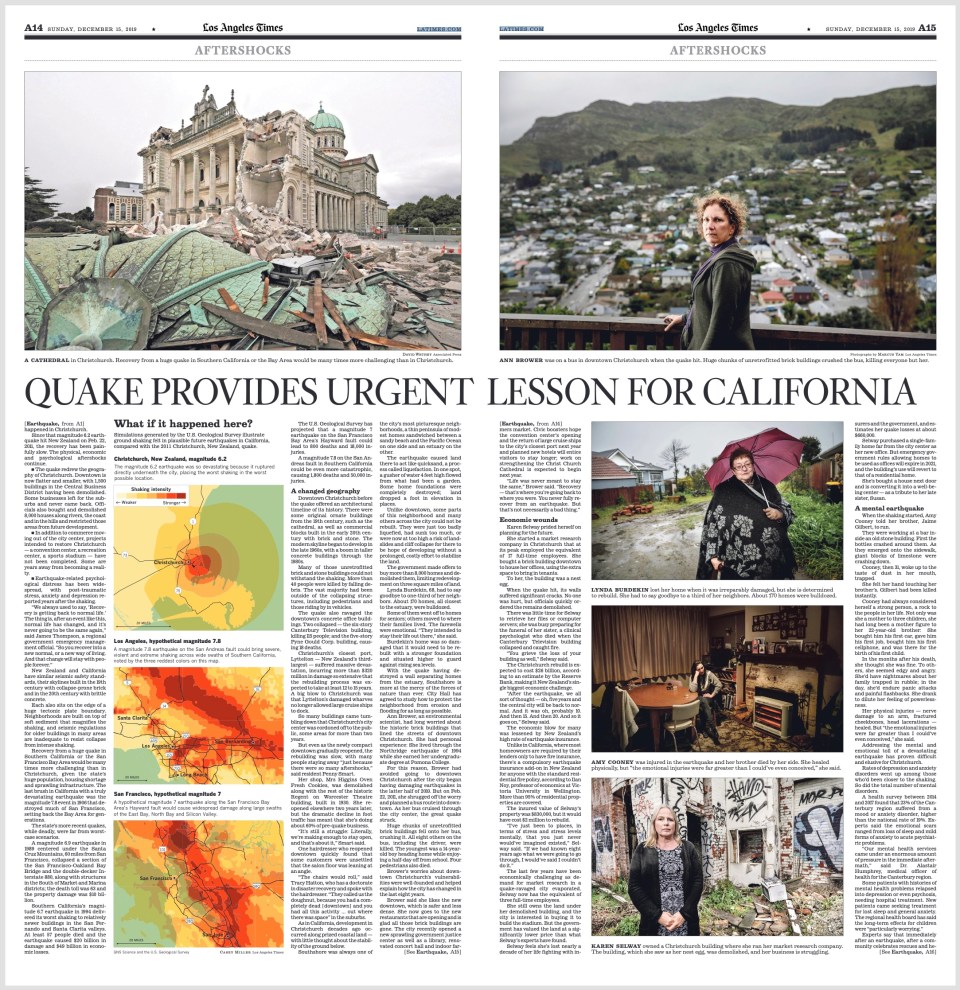

An excellent article published by the Los Angeles tells the story of property owners trying to put back together their lives following the earthquake in Christchurch, New Zealand.

“Karen Selway …started a market research company in Christchurch that at its peak employed the equivalent of 17 full-time employees. She bought a brick building downtown to house her offices, using the extra space to bring in tenants. To her, the building was a nest egg. When the quake hit, its walls suffered significant cracks. No one was hurt, but officials quickly ordered the remains demolished…“You grieve the loss of your building as well,” Selway said…The economic blow for many was lessened by New Zealand’s high rate of earthquake insurance. Unlike in California, where most homeowners are required by their lenders only to have fire insurance, there’s a compulsory earthquake insurance add-on in New Zealand …The insured value of Selway’s property was $830,000, but it would have cost $2 million to rebuild.

The insured value of Selway’s property was $830,000, but it would have cost $2 million to rebuild.

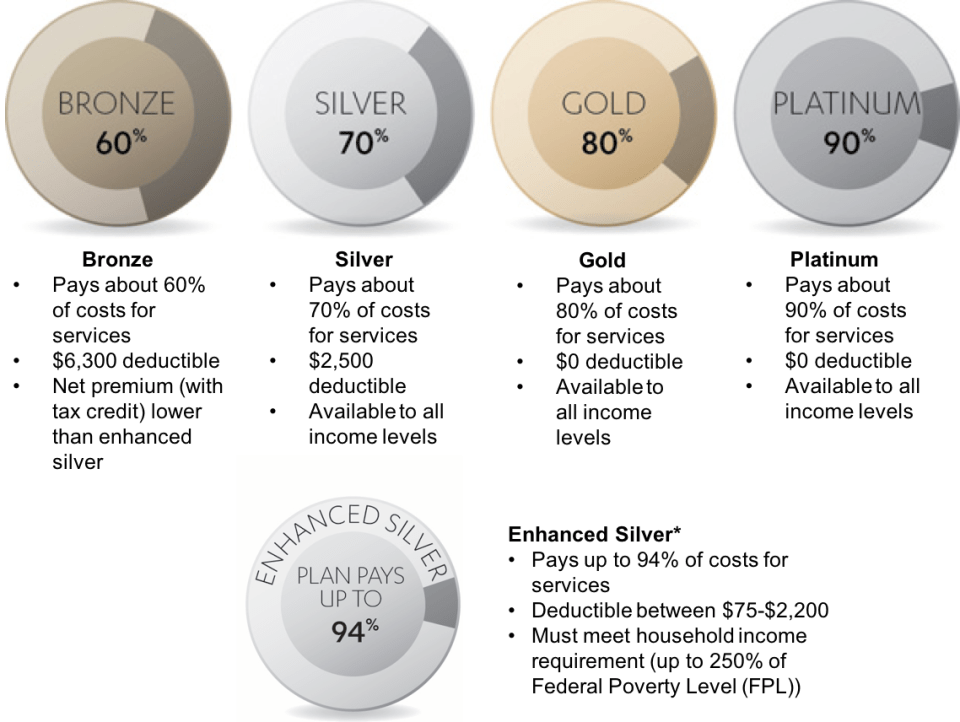

When purchasing earthquake or flood insurance, consider setting a limit of insurance that can cover the increased cost to rebuild during a demand surge.

Read the full article from the Sunday Edition of the Los Angeles Times, Dec 15th, 2019:

CALL:

626-765-4495

626-765-4495

Some California consumers received

Some California consumers received